Liverpool News

“We voted for change. Now we desperately need it in hospitality” – Paul Askew speaks out on Government budget

1 year ago

Government is set to release its budget this Wednesday, 30 October.

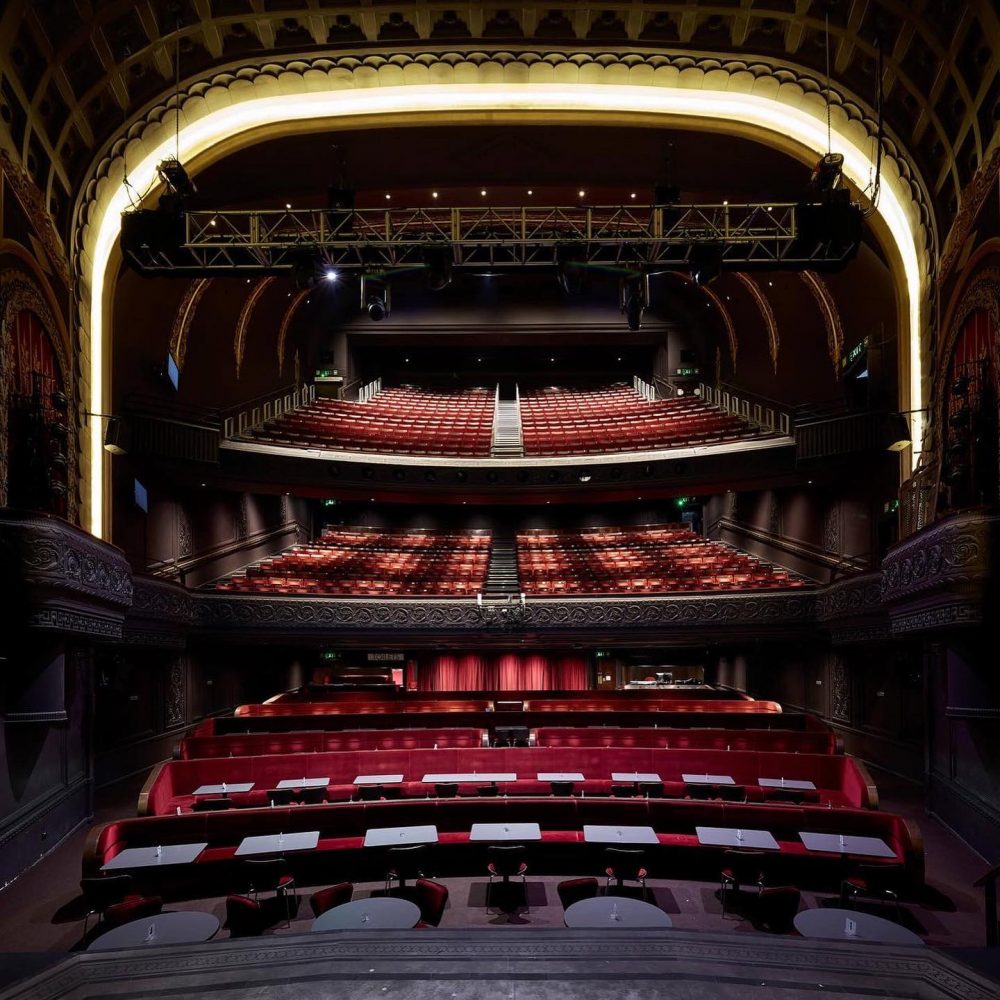

As the unveiling of the Government budget draws near, Chef Paul Askew, one of Liverpool’s leading culinary voices, has called for urgent reforms to address the hospitality sector’s crisis.

With closures occurring weekly, Paul Askew emphasises that escalating costs – from National Insurance contributions to potential tax hikes – are creating an already challenging situation.

For Liverpool, a city where hospitality fuels the economy, he argues for tax recalibration to allow the industry to thrive. Without government support, Askew warns, the sector may face an unprecedented wave of closures and redundancies.

Paul Askew said:

“Now we have got a new chancellor and government, with the incoming budget there’s a crucial chance to re-set what is an increasingly dire situation in hospitality.

“Many of us voted for change to bring this new government in. However, the expectation of increased National Insurance contributions for employers only and talk of changing tax thresholds and living wage increases sends alarm bells ringing in the hospitality sector, which desperately need recalibration.

“There’s an ongoing climate of uncertainty with closures of all kinds of hospitality businesses each week – shutting down for good because they can’t make their businesses add up any more. Turnover remains relatively the same broadly speaking for many operators I know both here in Liverpool and around the UK, but the reality is that making this turnover profitable is getting harder each day.

“We need an urgent recalibration in tax for hospitality, which generated £54bn in tax receipts in 2022. In Liverpool, the tourism industry – with hospitality forming a huge part – was worth £6.25bn in 2023. For a city with hospitality in its DNA, we need to increase this each year; the question remains how do we here, and across the UK, make this happen?

“Because we continue to face an incredibly demanding, draining and difficult set of circumstances. So unless the government really listens, we will see more closures and more redundancies. How many other fresh food-led businesses need to close to make the new government realise that they aren’t allowing the hospitality industry to grow, invest, employ and quite frankly survive?

“Unless swift action is taken, the sector is gearing to fail with post-Covid support long gone but the debts very much remaining, along with the ongoing lack of consumer confidence. And it’s not just restaurants – pubs, cafes, bars and more all face the most difficult trading landscape imaginable, with the perfect set of circumstances for failure.

“We would like to grow again and there are many obstacles preventing this growth.”

Some of the key pressure points Paul has highlighted:

- High VAT on fresh prepared food

- Business rates relief ending – the threat of rates increasing on April 1st 2025

- Energy costs

- Inflation of ingredients costs

- Wage increases

- Increased business PAYE and NI contributions

- Brexit tariffs on import of wine and international goods

- Cost of borrowing

- Servicing of CBIL loans businesses were forced to take out during the pandemic to survive

Paul Askew added:

“The single most important point is to recalibrate the VAT charge on fresh prepared food to be in line with Europe for fresh led businesses so we can grow, invest and thrive using artisan skills and develop our people and business normally, not just scraping through week by week. There’s a chorus of businesses across the UK asking for this.

“And we need business rates reform to create a level playing field for businesses with physical premises on the high street compared to online businesses and dark kitchens. It makes no sense how business rates are currently assessed and the fees levied, on top of the potential end to business rates relief next spring which would be another crippling blow.

“We voted for change. Now we desperately need it in hospitality. I really hope the chancellor and government are listening.”

Subscribe

Subscribe Follow Us

Follow Us Follow Us

Follow Us Follow Us

Follow Us Follow Us

Follow Us